Insurance Fund

Insurance Fund

The insurance fund provides a capital buffer to keep the exchange solvent and fair whilst trading with leverage. In the event of a counterparty bankruptcy, insurance funds cover losses and ensure the winning traders get paid out in full. Capitalizing the insurance fund is a shared cost for all traders who experience liquidations. Insurance funds are the second line of protection against system-wide capital drawdowns that result from negative-equity liquidations.

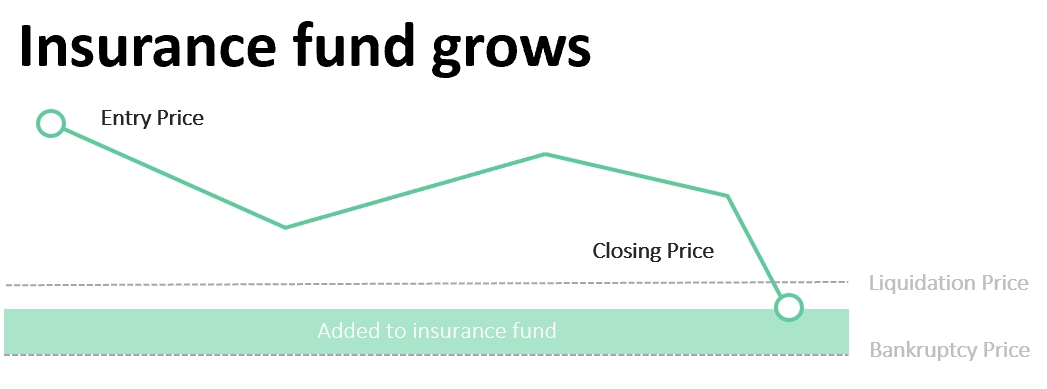

Scenario I: Contracts liquidated before bankruptcy & insurance fund grows

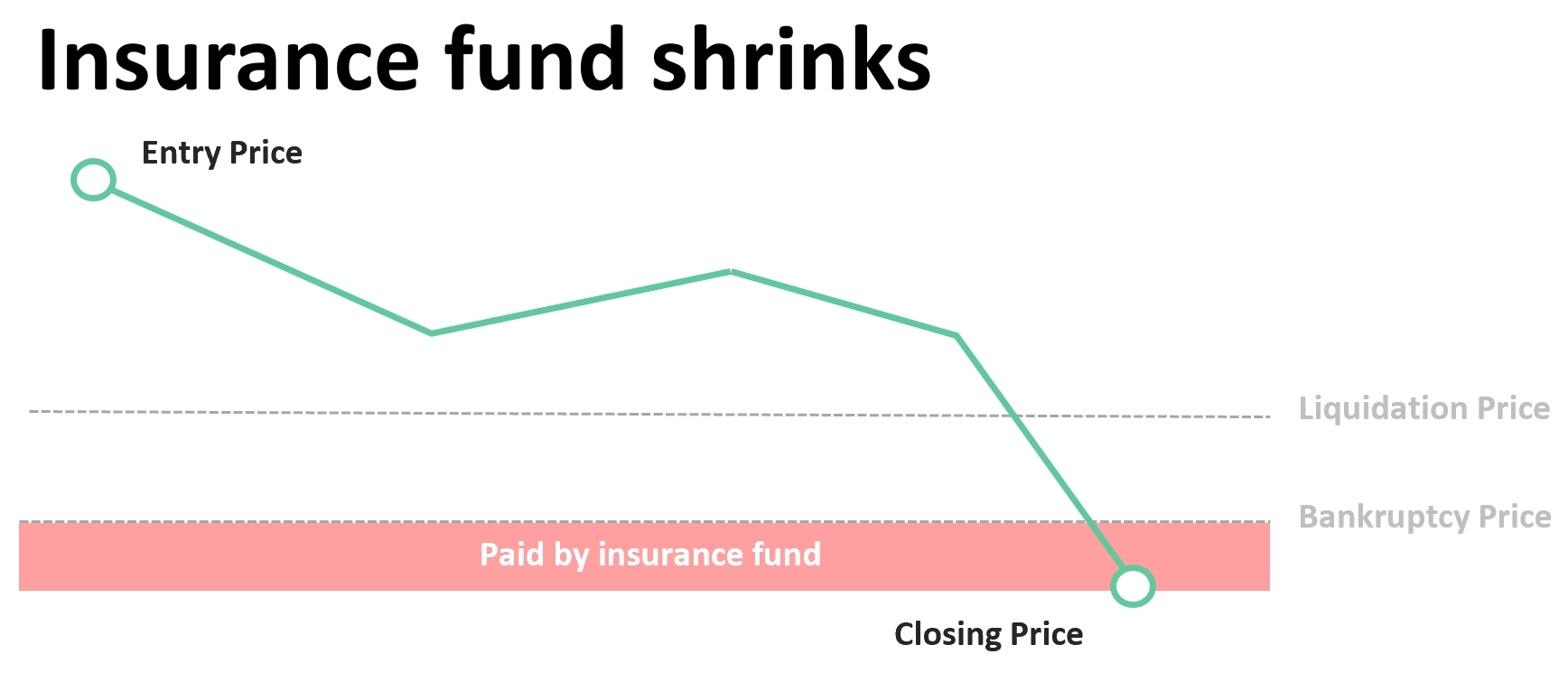

Scenario II: Insurance fund covers for an inefficient liquidation & insurance fund shrinks

Separate Insurance Funds per Market

Bluefin has implemented separate insurance funds for each market it offers. This means that each trading pair (such as BTC-PERP, ETH-PERP, and so on) has a dedicated insurance fund. The primary reason for this approach is to ensure that the risks associated with each market are isolated and managed independently.

There are several benefits to having separate insurance funds per market, including:

Isolate risks: Each market has its own unique characteristics and risk factors. By having separate insurance funds, Bluefin can ensure that the risks associated with one market do not spill over into other markets, thereby maintaining the overall stability of the platform.

Greater transparency: Separate insurance funds provide greater transparency for traders, who can easily view the balance and performance of each fund. This can help to build trust in the platform and its risk management capabilities.

Increased trader confidence: Traders can have greater confidence in the platform's ability to manage risk effectively, knowing that each market has its own dedicated insurance fund. This can lead to increased trading activity and liquidity on the platform.

Having separate insurance funds per market is a key component of Bluefin's commitment to providing traders a secure and reliable trading environment. By isolating risks and providing greater transparency, Bluefin ensures that traders can have confidence in the platform's ability to manage risk effectively and maintain overall stability.

Last updated